Students of the ‘Financial Security’ program develop additional competencies through non-formal and informal education

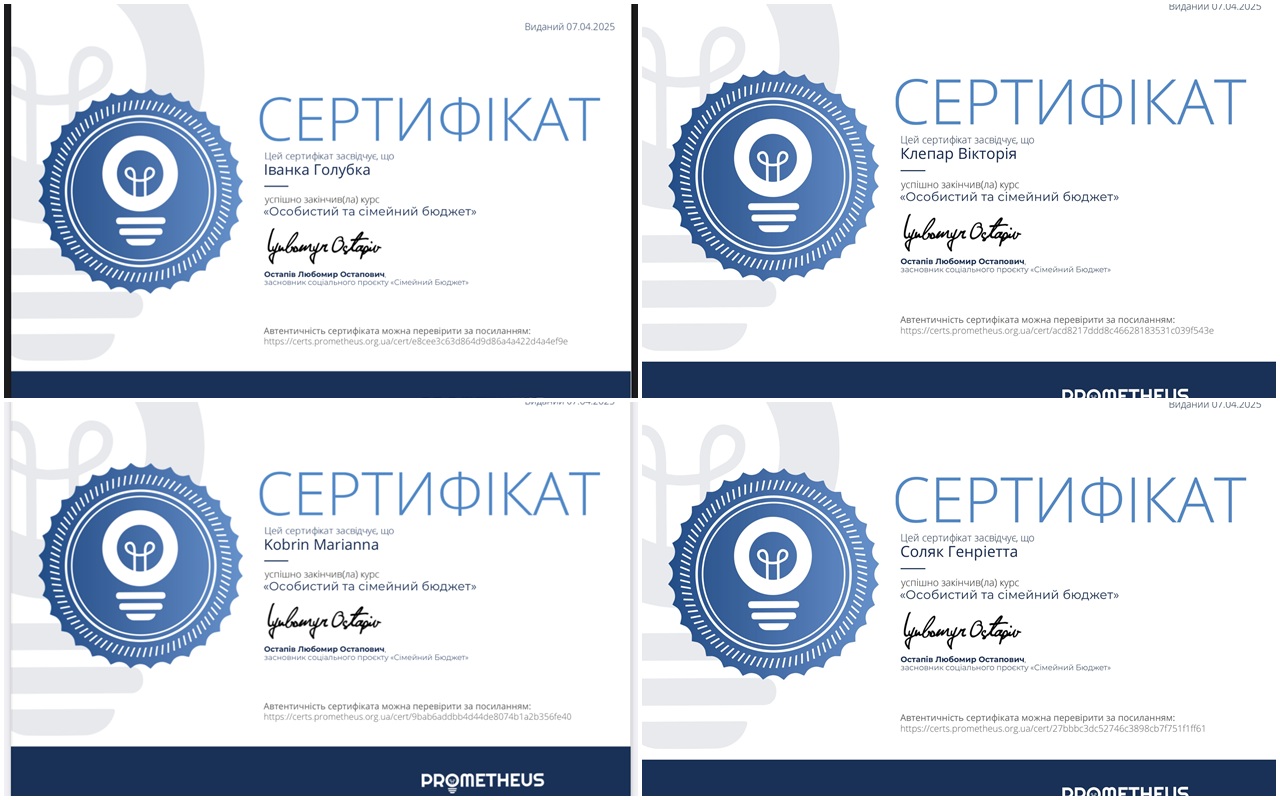

The 2nd year students specializing in Financial Security successfully completed their studies and received certificates for the course “Personal and Family Budget” (on-line platform Prometheus, author Liubomyr Ostapiv) as part of the study the topic “Household Finance” (course “Finance”).

The issue of self-education has become an extremely relevant in current context of dynamic changes in economic, financial, and social spheres. It has become a crucial tool for personal development and allows people to adapt to current trends, directions, and tendencies in various areas of life. This helps to develop an understanding of cause-and-effect processes in the economy and society, fosters critical thinking, facilitates the perception of new approaches and information, enhances flexibility to changes, and supports the adoption of effective decision-making.

The intense course program allowed students to learn the concept of financial literacy, the basics of money psychology, tools for auditing their financial situation, tracking personal income and expenses, the importance of creating a financial emergency fund, the advantages of savings and endowment insurance, as well as useful financial habits that are available to everyone.

“On the course, we learned more in-depth about the family budget and how to manage it, personal expenses, and the insurance market. All the information was very useful, and I believe it will help us both in our classes for a better understanding of finances and in life, for managing money properly. I really liked the advice on investing money and handling it properly” (Ivanna Holubka).

“In this course, I learned how to be a financially literate person and how important it is for life. It was interesting to learn that when we are emotional, we do not control very well how we spend money, and that we need to know how to save. The course also included tests that helped me better understand the topics.” (Viktoria Klepar).

“During the course, I learned how to save my money properly, what emotions arise during purchases, what insurance is, which assets generate income and which do not, and how to manage my funds properly” (Marianna Kobryn).

“From the course, I learned that I need to understand for myself whether money is evil or a resource. Emotions during purchases (fear, sadness, or joy) are very important. It was interesting to learn about the Pareto principle (we should save 20% of our income, and the remaining 80% can be used freely), Parkinson’s Law (people tend to spend all they earn, so money should be saved as soon as it arrives in the account or wallet), the Grain Law (it takes time to grow income), and the importance of auditing own financial situation” (Henrietta Solyak).

Congratulations to our students on acquiring additional knowledge and skills that will definitely be useful in their future lives!

-

This article is also available in

Українська

Magyar